Uninsured in Germany: "We're the Serfs of the Doctors"

- By: Bernhard Albrecht

- Approx. Reading Time: 10 Minutes

Uninsured Individual Faces Financial Burden: A Real-Life Example Illustrating Potential Consequences - Unveiling the Pathway to Data Violations: A Real-World Example

Meet Heinz Hoenig, a 73-year-old actor and Annika, his wife, whose lives have been put on hold due to a lack of health insurance. Their story has been making headlines since last year after Hoenig fell ill and racked up medical bills totaling over 100,000 euros, saved only by generous donations from their fans. Their situation remains precarious, with further operations looming on the horizon.

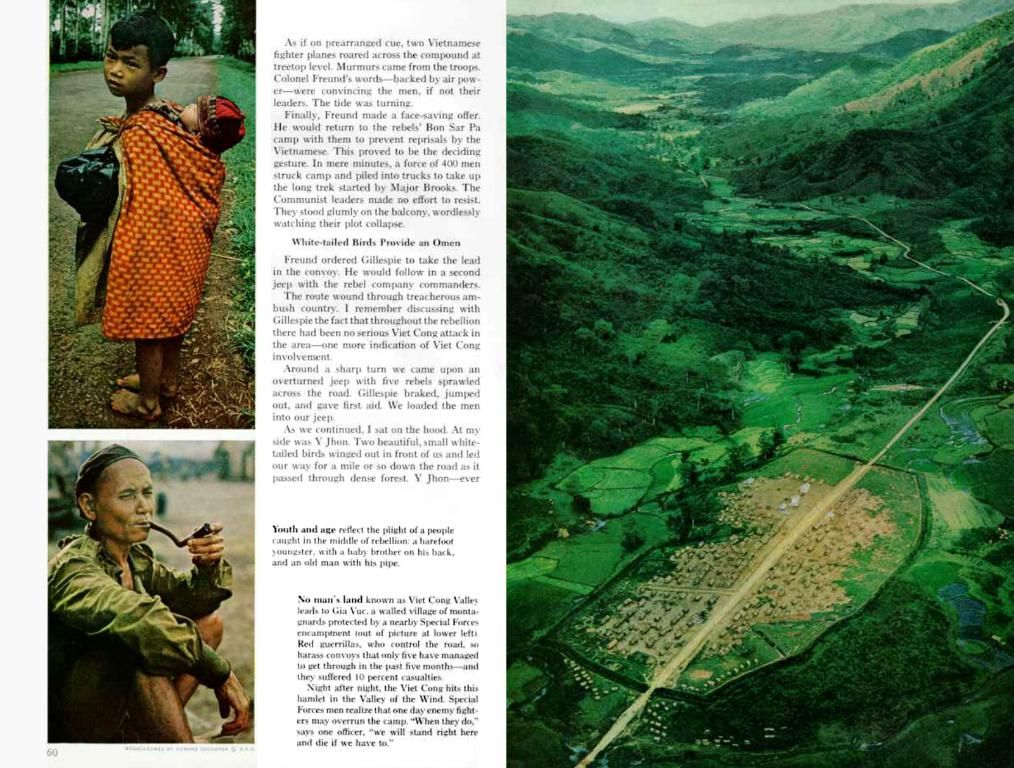

Unlike the Hoenigs, the 22-year-old Constantin S. and his mother Cornelia have never received such support. Their family lives perilously close to poverty, and a serious illness would inevitably lead to financial ruin. After reaching out to stern magazine about stories they'd heard regarding uninsured individuals, Cornelia shared their struggles, stating, "It's not just the homeless or those who opt out of the solidarity community who are affected, but people like me and my family."

In theory, such cases shouldn't exist

In principle, every German citizen should have access to health insurance through a health insurance company or private insurance. The law mandates that coverage can only be revoked under specific circumstances, but as with any legislation, loopholes persist. The S. family fell through one of these gaps.

Related Topics:- Health Insurance- Health Insurance Company- Administrative Errors- Doctor's Visit

The Gray Areas of Germany's Healthcare System

Despite the best intentions of the German health insurance system, there are several ways individuals like the S. family can wind up uninsured or face coverage gaps. These situations aren't necessarily intentional loopholes, but rather the complexities inherent in the system:

1. Interrupted Coverage- Job Loss or School Completion: When individuals lose their job or finish school, they must ensure they have continuous health insurance, either through a different policy or using an Anwartschaft (standby policy) to preserve their right to re-enter public insurance[1].- Expatriation or Extended Travel Abroad: If temporary moves are made outside the EU/EEA for work, education, or other reasons, individuals may become eligible for an Anwartschaft, which maintains their public insurance but does not provide active coverage. If alternative insurance is not arranged, they may find themselves without coverage for medical expenses abroad or in Germany if their Anwartschaft is not properly reactivated[1].

2. Restricted Access to Private Insurance- Income Thresholds: Only employees earning above the yearly income threshold (e.g., €69,300 gross in 2024, but sometimes updated) can freely choose private insurance. Freelancers and self-employed individuals are also eligible. If someone loses their job or drops below this threshold, they may experience difficulty returning to public insurance, especially if they did not maintain an Anwartschaft[2][3].- Switching between Public and Private Insurance: Once someone switches to private insurance, rejoining the public healthcare system can be challenging, particularly if they fail to maintain their Anwartschaft or meet other requirements[3].

3. Lack of Awareness or Administrative Mistakes- Ignorance of Mandatory Insurance: Some individuals may not realize that health insurance is mandatory in Germany, resulting in unintended gaps in coverage[1].- Delayed Registration: If someone fails to register with public or private insurance promptly after losing previous coverage, they may experience a period uninsured[1].

4. Limitations of the Anwartschaft Policy- Lack of Active Coverage: The Anwartschaft only safeguards the right to reenter public insurance later but does not provide active medical coverage. Individuals must secure separate insurance during this period, a detail some may overlook[1].- Eligibility Restrictions: The Anwartschaft is not available to all individuals, such as those moving within the EU/EEA or employees sent abroad temporarily by their German employer[1].

The S. Family's Potential Misfortune

The S. family could find themselves uninsured if:- They moved abroad without arranging alternative coverage.- An income loss caused them to lose eligibility for private insurance, and they failed to quickly address the situation or maintain their Anwartschaft.- They were unaware of the mandatory insurance requirement or overlooked administrative deadlines for switching or reactivating their insurance.

Key Takeaways

- Interrupted Coverage: Ensure you have continuous health insurance—public, private, or through an Anwartschaft—when transitions occur, such as job loss, school completion, or moving abroad.

- Restricted Access to Private Insurance: Be mindful of the yearly income threshold and its impact on your insurance options. If you lose your job or drop below the threshold, consider options like returning to public insurance or securing alternative coverage.

- Lack of Awareness and Administrative Mistakes: Keep aware of the mandatory nature of health insurance in Germany, and promptly register with a public or private insurer when necessary. Be diligent to ensure you maintain active coverage.

- Limitations of the Anwartschaft Policy: Understand the limitations of your Anwartschaft, including its inability to provide active coverage and eligibility restrictions. Secure alternative insurance during this period to avoid unintended gaps in coverage.

These potential pitfalls underscore the importance of staying informed and vigilant when managing health insurance in Germany to prevent unplanned gaps in coverage that could jeopardize your well-being or financial stability.[1][2][3]

[1] "Germany: Health insurance for expats." Expatica, www.expatica.com/de/health/health-insurance-for-expats-141357

[2] "Private Insurance in Germany: What You Need to Know." ExpatHub, www.expathub.com/private-health-insurance-in-germany

[3] "Health Insurance in Germany: A Guide for Expats." InterNations, www.internations.org/expat-info/article/health-insurance-in-germany-a-guide-for-expats-40882

[4] "Health insurance: automatic termination." EasyExpat, www.easyexpat.com/en/germany/working-in-germany/health-insurance/health-insurance-automatic-termination

[5] "Health insurance: eligibility for private insurance." EasyExpat, www.easyexpat.com/en/germany/working-in-germany/health-insurance/health-insurance-eligibility-for-private-insurance

[6] "Health insurance: Anwartschaft." EasyExpat, www.easyexpat.com/en/germany/working-in-germany/health-insurance/health-insurance-anwartschaft

- Community policy should clearly outline the ways individuals can avoid falling through insurance gaps, such as those related to job loss, school completion, expatriation, or extended travel abroad.

- Vocational training programs could educate workers on the importance of maintaining health insurance and the consequences of unintended gaps in coverage.

- The complexity of the healthcare system contributes to administrative errors and lack of awareness, making it crucial to simplify processes and provide clearer communication regardingmandatory insurance requirements and compliance deadlines.

- Chronic diseases and medical-conditions can exacerbate financial difficulties for individuals uninsured or underinsured, highlighting the need for comprehensive and affordable healthcare.

- Cancer treatments are typically expensive, making it essential for individuals to ensure they have proper insurance coverage to avoid astronomical medical bills.

- Respiratory conditions and digestive-health issues can also require costly treatments, underscoring the importance of continuous health insurance.

- Early detection and management of eye-health, hearing, and skin-conditions can reduce long-term costs, emphasizing the benefits of regular check-ups and consistent insurance coverage for preventive care.

- Health-and-wellness practices such as fitness-and-exercise, sexual-health education, and mental-health resources are vital components of whole-person wellness, which should not be compromised due to insurance gaps.

- Autoimmune-disorders, neurological-disorders, and other complex medical conditions can be costly and require long-term therapies-and-treatments, necessitating continuous insurance coverage to ensure access to necessary care.

- Nutrition plays a significant role in overall health, making it essential for individuals to have access to resources and support to ensure a balanced diet, regardless of their insurance status.

- Aging populations are more susceptible to chronic diseases, necessitating affordable and comprehensive healthcare for all, not just the wealthy.

- Women's-health and men's-health issues require specialized care and resources, which should be accessible to everyone, regardless of insurance coverage.

- Parenting resources, including maternal and child health services, should be supported through adequate insurance coverage to ensure the well-being of families.

- Effective weight-management strategies can help prevent obesity, diabetes, and cardiovascular-health issues, which are often related to nutrition and overall lifestyle.

- Medicare should offer policies that cover not just the elderly but also those with chronic diseases and low-income households, promoting equality in access to healthcare.

- CBD products have been purported to have various health benefits, but their lack of regulatory oversight may pose risks for consumers, necessitating careful consideration of insurance coverage for these products.

- Financial education and wealth-management resources should be made readily available to help individuals make informed decisions regarding insurance, budgeting, saving, debt-management, and investment strategies.

- Policy-and-legislation must address gaps in the healthcare system, finding solutions for those who fall through the cracks due to administrative errors, lack of awareness, or income insecurity.

- Accident insurance is essential for individuals to protect themselves from unforeseen expenses related to car-accidents, fires, or injuries at home or work.

- Car-accident victims may suffer from long-term injuries, necessitating extended rehabilitation or therapies, which can be financially devastating without proper insurance coverage.

- Migration policies should provide adequate insurance options for uprooted families, ensuring they have access to necessary healthcare services in their new country.

- War-and-conflicts have long-lasting effects on mental-health, necessitating access to resources and support for those impacted, especially for refugees and displaced persons.

- Policy-and-legislation addressing crime-and-justice reform can help protect vulnerable populations from exploitation by unscrupulous healthcare providers.

- General news outlets can raise awareness about the struggles of uninsured individuals, shedding light on potential reforms and supporting efforts to close coverage gaps.

- Awareness campaigns on the importance of health insurance and preventive care can help break the stigma surrounding mental-health, sexual-health, and other sensitive topics.

- Establishing partnerships between community organizations, healthcare providers, and insurance companies can help bridge gaps in coverage and provide a more holistic approach to health-and-wellness.